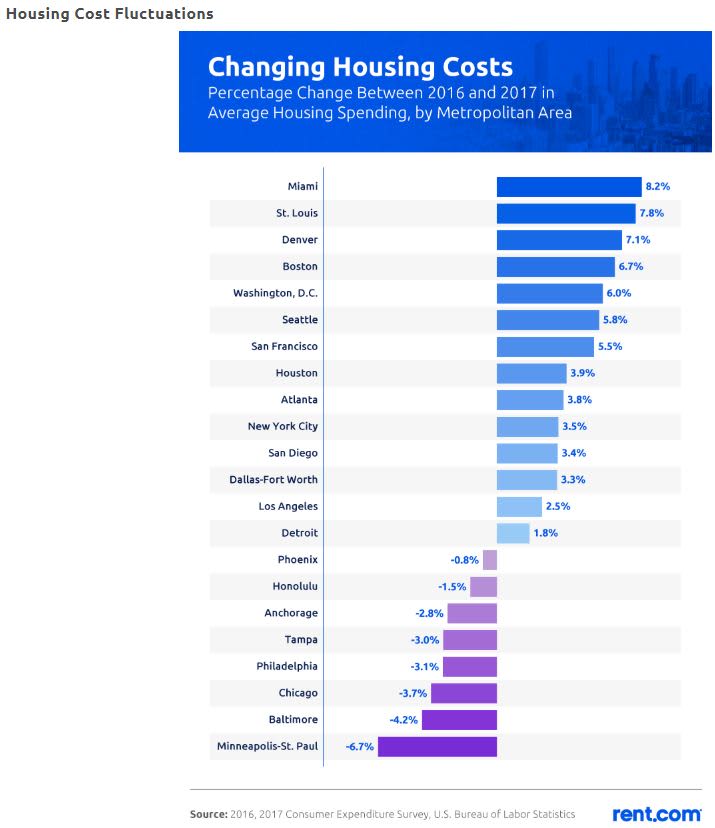

If you want to live in a big city but have a tight budget, you may want to avoid places such as Miami and and Denver, where housing costs are rising year over year.

That’s according to a recent report from Rent.com on the cost of city living, which analyzed data from the 2016 and 2017 editions of the U.S. Consumer Expenditure Survey, which is conducted annually by the U.S. Bureau of Labor Statistics. The report looked at the change in housing costs in 22 major metropolitan areas over 12 months.

In addition to mortgages and rental costs, the BLS includes property taxes, maintenance, utilities, household products and furnishings in its definition of housing costs.

Of the areas surveyed, Miami experienced the most significant increase in housing costs between 2016 and 2017, spending an average of 8.2% more on housing over the course of the year. That can be attributed in part to the fact that mortgage costs rose faster than local wages over the same period, the Miami New Times reports.

St. Louis saw the second highest rise in housing spending with an average increase of 7.8%. That made an impact: Between 2016 to 2017, the percentage of St. Louis residents who are severely cost-burdened, meaning they spend 50% or more on housing, increased more than 2%, according to a survey from Apartment List.

Source: 2016, 2017 Consumer Expenditure Survey, U.S. Bureau of Labor Statistics; Click to enlarge

Here’s the full list of the 10 U.S. cities that saw the biggest increases in housing costs between 2016 and 2017:

- Miami, Florida: 8.2% increase

- St. Louis, Missouri: 7.8% increase

- Denver, Colorado: 7.1% increase

- Boston, Massachusetts: 6.7% increase

- Washington D.C.: 6% increase

- Seattle, Washington: 5.8% increase

- San Francisco, California: 5.5% increase

- Houston, Texas: 3.9% increase

- Atlanta, Georgia: 3.8% increase

- New York, New York: 3.5% increase

However, many major cities have actually gotten cheaper. In Minneapolis, housing spending dropped 6.7% on average, followed by Baltimore with a 4.2% decrease and Chicago with a 3.7% decrease.

Regardless of location, housing costs take up a significant portion of city dwellers’ paychecks. In 2017, the national average for income spent on housing was 27%, the report found. While that falls beneath the recommended 30%, it still means many are spending above what is considered financially manageable.

Residents of Los Angeles and Boston put an average of 31.8% and 30.5%, respectively, of their income toward housing in 2017, the report found. In New York City, residents spent an average of 29.6% of their income on housing, nearly exceeding the 30% mark.

Is city life worth it?

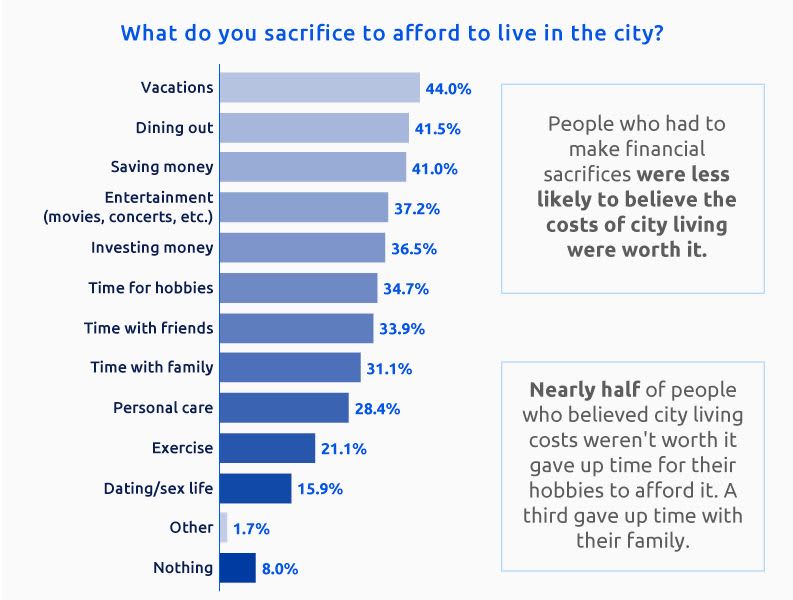

In order to afford city living, many have had to cut down on spending in other areas of life. Vacations, dining out and saving money are the top sacrifices city dwellers make, according to Rent.com’s independent survey of 573 people living in one of 10 major metropolitan areas in the U.S.

Only 8% of survey respondents say they have to sacrifice nothing to afford their metropolitan lifestyle.

Source: Rent.com Survey of 573 Major City Residents; Click to enlarge

Is the high cost of living in a major city worth it? Just over half (55%) of survey respondents say yes. Another 30.7% say no and 14.3% are neutral. But that doesn’t mean city dwellers want to stay forever: 78% of respondents say they are open to moving at some point and 12.4% say they want to move away as soon as possible. Just 9.6% say they want to stay put for the rest of their lives.

When determining whether to live in a big city or somewhere cheaper, it ultimately comes down to your circumstances and priorities. If job security or earning a higher salary are among your reasons for living in a big city, you’re probably in the right place, given that cities are often considered hot spots for high-paying jobs.

But if you choose to live somewhere more affordable, you might find it easier to achieve the lifestyle you want without needing to cut back on things like entertainment or dining out.

Still weighing your options? Here’s an idea of where to buy if you want to become a city-dwelling homeowner for less. And if quality of life is what you truly care about, these 10 cities are ranked highly.

Source – CNBC