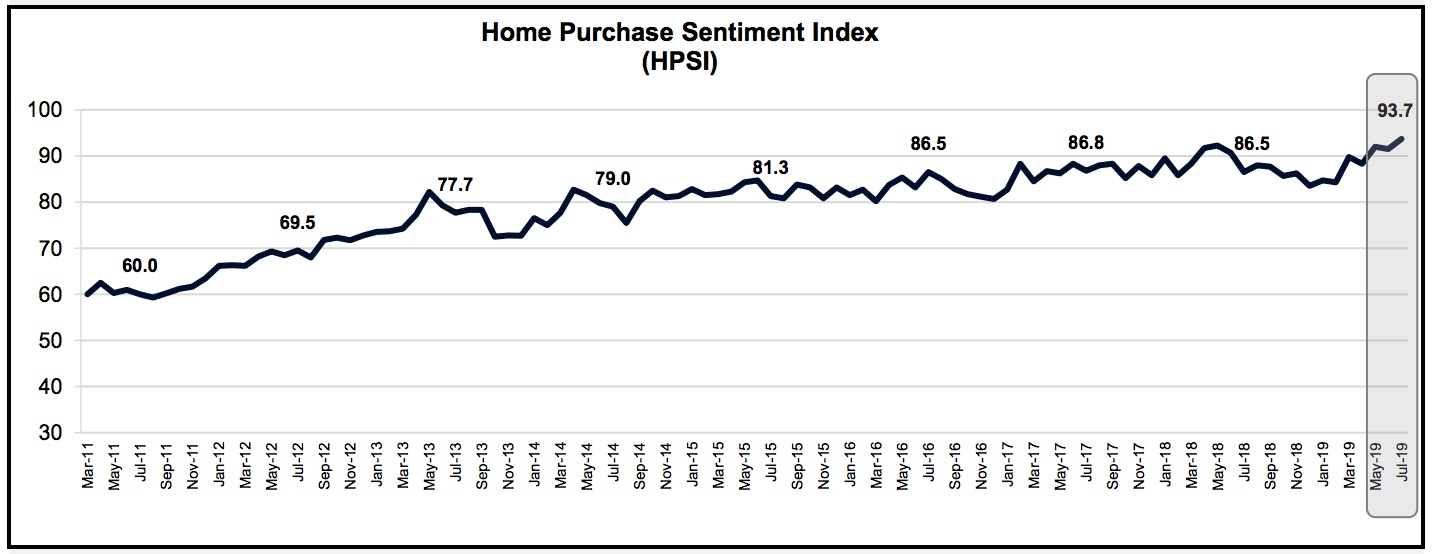

There was an unusually large bump in Fannie Mae’s Home Purchase Sentiment Index (HPSI) in July. The company said strong positive responses to questions on the National Housing Survey (NHS) about job security and interest rate declines sent the index up 2.2 points compared to June. The HPSI, at a 93.7 reading, is up 7.2 points compared to the same time last year.

Five of the six components of the NHS rose on a month over month basis and four were higher year-over-year. The increase in the Index was primarily driven by an 8-percentage point increase in net positive responses to the question regarding confidence in job security. Net positive responses were at 81 percent, 16 points higher than in July 2018.

Net positive responses to whether it is a good time to buy a house increased by 3 points to 26 percent, 2 points higher than a year ago while the same question about selling was up 1 point to a net of 44 percent, a 3 point annual increase.

While the net is still deep in negative territory, the largest annual increase was a 24-point gain in the responses to whether mortgage rates will go down. The -28 reading is 1 point higher than last month.

Positive responses to whether home prices would continue to move higher slipped again this month, down to 37 percent compared to 38 percent in June and 39 percent in July 2018. The net number of respondents who said their income had increased significantly over the previous 12 months rose 1 point to 21 percent but was unchanged year over year.

“Consumer job confidence and favorable mortgage rate expectations lifted the HPSI to a new survey high in July, despite ongoing housing supply and affordability challenges,” said Doug Duncan, Senior Vice President and Chief Economist. “Consumers appear to have shaken off a winter slump in sentiment amid strong income gains. Therefore, sentiment is positioned to take advantage of any supply that comes to market, particularly in the affordable category. However, recent financial market events following when the survey data were collected could weigh on consumer views looking ahead.”

The NHS, from which the HPSI is constructed, is conducted monthly by telephone among 1,000 consumers, both homeowners and renters. In addition to the six questions that form the framework of the index, respondents are asked questions about the economy, personal finances, attitudes about getting a mortgage, and questions to track attitudinal shifts. The July 2019 National Housing Survey was conducted between July 1, 2019 and July 23, 2019.

Source – MND