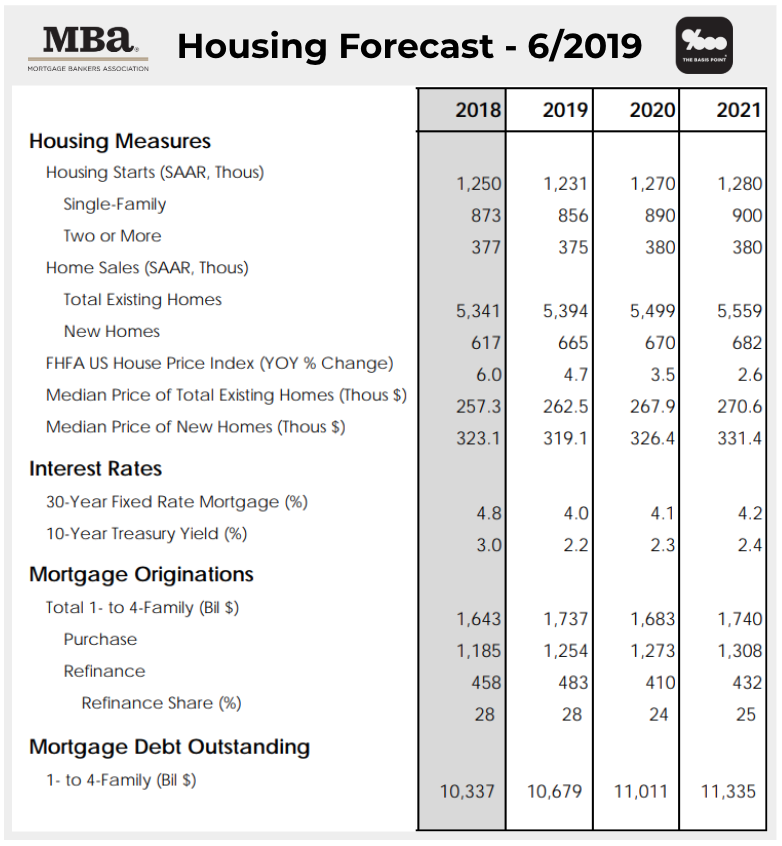

Last week, our friends at the MBA released their latest predictions on home sales, home prices, mortgage rates, and mortgage volumes.

Rates dropping this year has caused an increase in the total expected loans to close for 2019, driven by an increase in refinance loans vs. home purchase loans. Previously, the MBA was projected that the 2019 to be about $1.6 trillion in loans with 75% of them being purchase loans.

Now they’re calling for a total of $1.7 trillion loans to be made this year, and 72% of them being purchase loans.

Still the bulk of the market is purchase vs. what the market had become accustomed to with refinance loans coming close to 50% for many years up until the last few.

This has profound implications for how the lending and real estate business is changing because finding and keeping home purchase customers is a lot different, and more difficult, for lenders.

I’ll be talking more about this next week. Stay tuned…

Source – The Basis Point